5 Steps to a 5: AP Macroeconomics 2017 (2016)

STEP 4

Review the Knowledge You Need to Score High

CHAPTER 10

Fiscal Policy, Economic Growth, and Productivity

IN THIS CHAPTER

Summary: The model of AD and AS is a useful mechanism for looking at how the macroeconomy can be deliberately expanded, or contracted, by the government. Fiscal policy measures include government spending and tax collection to affect economic output, unemployment, and the price level. We use graphical analysis to show how fiscal policy attempts to move the economy to full employment and also discuss some of the ways in which fiscal policy is less effective than predicted by theory. This chapter concludes with a discussion of economic growth and productivity, and how policy might affect growth.

Key Ideas

![]() Fiscal Policy

Fiscal Policy

![]() Budget Deficits and Crowding Out

Budget Deficits and Crowding Out

![]() Economic Growth

Economic Growth

![]() Productivity and Supply-Side Policy

Productivity and Supply-Side Policy

10.1 Expansionary and Contractionary Fiscal Policy

Main Topics: Expansionary Fiscal Policy, Contractionary Fiscal Policy, Deficits and Surpluses, Automatic Stabilizers

This section of the chapter uses AD and AS to illustrate how fiscal policy can work in theory. Fiscal policy stresses the importance of a hands-on role for government in manipulating AD to “fix” the economy. Difficulties in fiscal policy and the supply-side perspective are addressed in the following section.

Expansionary Fiscal Policy

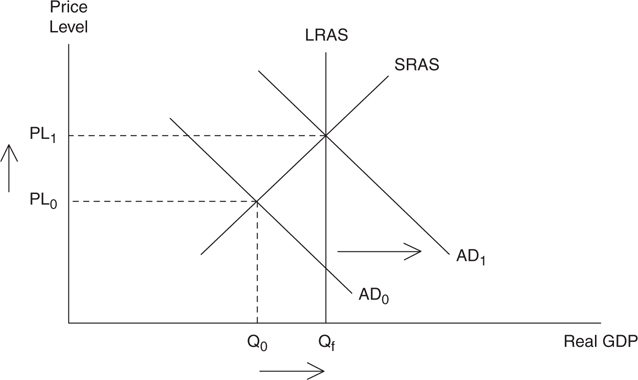

When the economy is suffering a recession, real GDP is low and unemployment is high. In the AD and AS model, a recessionary equilibrium is located below full employment, as shown in Figure 10.1 . If the government increases its spending or lowers net taxes, the AD curve increases. Net taxes, if you recall, are tax revenues minus transfer payments. Of course, if the government is using tax cuts, rather than government spending, to expand the economy, the multiplier is smaller; so to get the same increase in real GDP, the size of the tax cut must be larger than an increase in government spending.

Figure 10.1

Contractionary Fiscal Policy

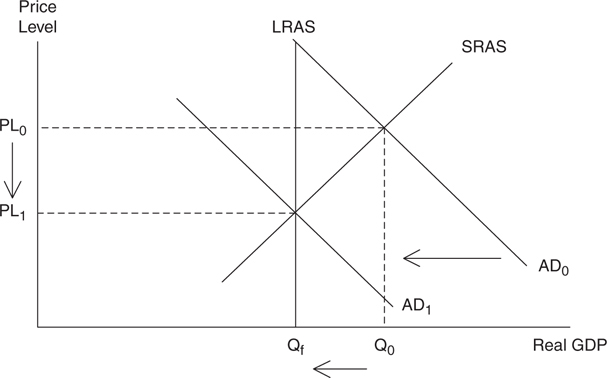

If the economy is operating beyond full employment, and inflation is becoming a problem, the government might need to contract the economy. This inflationary equilibrium is seen beyond full employment, as shown in Figure 10.2 . This can be done by decreasing government spending or by increasing taxes, both of which cause a leftward shift in AD. The economy should see a little decrease in real GDP, but ideally a substantial decrease in the rate of inflation.

Figure 10.2

Are Prices Sticky?

Do prices fall, as Figure 10.2 seems to indicate? One of the points of contention is whether the price level can fall. Many economists (Keynesians) predict that prices are fairly inflexible, or “sticky” in the downward direction, so efforts to fight inflation are really efforts to slow inflation, not to actually lower the price level. Conversely, Classical school economists believe that the long-run economy naturally adjusts to full employment, and so they see the AS curve as vertical. This argument implies that prices are flexible and can rise and fall, as seen in Figure 10.2 .

Deficits and Surpluses

When the government starts to adjust spending and/or taxation, there is an effect on the budget. A budget deficit exists if government spending exceeds the revenue collected from taxes in a given period of time, usually a year. A budget surplus exists if the revenue collected from taxes exceeds government spending.

The Difference Between Deficit and Debt

An annual budget deficit occurs when, in one year, the government spends more than is collected in tax revenue. To pay for the deficit, the government must borrow funds. When deficits are an annual occurrence, a nation begins to accumulate a national debt . The national debt is therefore an accumulation of the borrowing needed to cover past annual deficits.

Expansionary Policy

If the economy is in a recession, the appropriate fiscal policy is to increase government spending or lower taxes. When the government spends more, or collects less tax revenue, budget deficits are likely. There are two ways to finance the deficit, and each has the potential to weaken the expansionary policy.

• Borrowing . If a household wants to spend beyond its means, it enters the market for loanable funds as a borrower. The borrowed funds provide a short-term ability to purchase goods and services, but must be paid back, with interest, when the loan is due. The same is true when the government borrows, but when an entity as large as the federal government is borrowing from the banking system, the public, or foreign lenders, in the form of Treasury bonds, it increases the demand for loanable funds. This, in turn, increases the real rate of interest and reduces the quantity of funds available for private investment opportunities. So what? Well, if the goal is to expand the macroeconomy, then borrowing to finance the deficit slows down the expansion by increasing interest rates. This crowding-out effect is examined in the next section of this chapter.

• Creating money . The creation of new money to fund a deficit can avoid the higher interest rates caused by borrowing. The primary disadvantage of creating more money is the risk of inflation, which can also lessen the effectiveness of expansionary fiscal policy. The effect that inflation has on the multiplier was illustrated in the previous chapter, and more detailed effects of expanding the money supply are looked at in the next chapter.

Contractionary Policy

If the economy is operating above full employment, the appropriate fiscal policy is to lower government spending or raise taxes. When the government spends less, or collects more tax revenue, a budget surplus can occur. The effectiveness of the contractionary fiscal policy depends upon what is done with the surplus.

• Pay down debt . If the government pays down debt and retires bonds ahead of schedule, the demand for loanable funds decreases, decreasing interest rates. Lower interest rates stimulate investment and consumption, which counters the contractionary fiscal policy and lessens the downward effects on the price level.

• Do nothing . By making regularly scheduled payments on Treasury bonds and retiring them on schedule, idle surplus funds are removed from the economy. By not allowing these funds to be recirculated through the economy, the anti-inflationary fiscal policy can be more effective.

Automatic Stabilizers

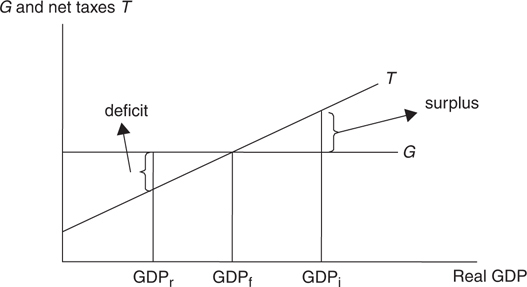

An automatic stabilizer is anything that increases a deficit during a recessionary period and increases a budget surplus during an inflationary period, without any discretionary change on the part of the government. There are some mechanisms built into the tax system that automatically regulate, or stabilize, the macroeconomy as it moves through the business cycle by changing net taxes collected by the government.

Progressive Taxes and Transfers

When the economy is booming and GDP is increasing, more and more households and firms begin to fall into higher and higher tax brackets. This means that a larger percentage of income is taken as income tax, which slows down the consumption of both households and firms. In addition, a strong economy reduces the need for such transfer payments as unemployment insurance and welfare. Thus, net taxes increase with GDP. Our progressive tax system is therefore contractionary when the economy is very strong. By automatically putting the brakes on spending, this reduces the threat of inflation and contributes to a budget surplus.

When the economy is suffering a recession and GDP is falling, households and firms find themselves in lower tax brackets. With a smaller percentage of income being taken as income tax, this provides a way for more consumption than would have been possible at the higher tax rate. Simultaneously, a weak economy increases the need for transfer payments like welfare payments. Thus, net taxes decrease with GDP. When the economy is sluggish, the progressive tax system is expansionary in nature. The lower tax brackets soften the effect of a recession and contribute to a deficit.

Figure 10.3 shows how, for a given level of government spending, net taxes rise and fall with GDP. These automatically reduce the threat of inflation when the economy is strong (GDPi ) and reduce the negative effects of a recession when the economy is weak (GDPr ). Ideally, at full employment (GDPf ), the budget should be balanced.

Figure 10.3

• Automatic stabilizers lessen, but do not eliminate, the business cycle swings.

• Automatic stabilizers lead to deficits during recession and surpluses during economic growth.

10.2 Difficulties of Fiscal Policy

Main Topics: Crowding Out, Net Export Effect, State and Local Policies

In theory, aggregate demand can be expanded or contracted, with government spending and/or taxes, to move the economy closer to full employment. In practice, there are some factors that lessen the effectiveness of fiscal policy. There are also some economists who disagree on fiscal policy targets.

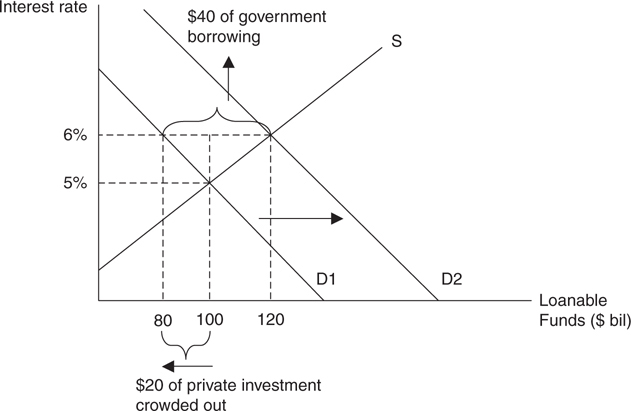

Crowding Out

If the government must borrow funds to pay for expansionary fiscal policy, the government has an effect on the market for loanable funds. The market for loanable funds was introduced earlier in this text, and you might recall that public borrowing (in the form of a budget deficit) affects the demand for loanable funds. A government deficit increases the total demand for loanable funds but, by raising the real interest rate, reduces the quantity of loanable funds available to the private borrowers and investors. Less investment spending on capital goods is likely to reduce a nation’s growth rate, a topic we’ll explore at the end of this chapter.

Figure 10.4 shows how a government budget deficit affects the demand for loanable funds and how we see crowding out. At the initial equilibrium, the real interest rate is 5%, the government has a balanced budget, and $100 billion is being saved by households and invested by firms.

Figure 10.4

“Crowding out is an important concept that may get asked more than once.”

—AP Teacher

Now suppose that government fiscal policy creates a $40 billion budget deficit. To cover the deficit, the government must borrow $40 billion in the market for loanable funds. The new demand curve (D2) is simply the original demand curve, only it lays $40 billion to the right of D1. The new market equilibrium interest rate is 6%, and $120 billion is saved and invested. But remember that of this $120 billion, $40 billion is due to borrowing by the government. That leaves $80 billion in private borrowing and investment. So the government budget deficit caused private borrowing and investment to fall from $100 billion to $80 billion, and that is where we see the crowding out of $20 billion in private investment.

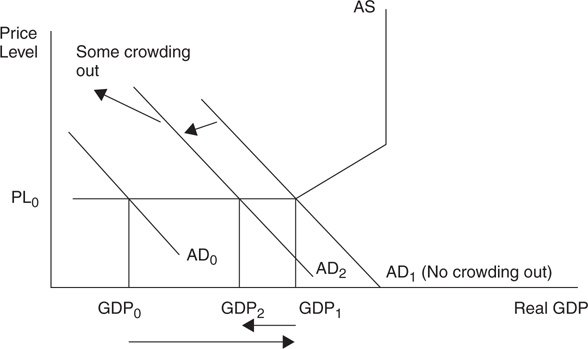

When the interest rate increases, households and firms are “crowded out ” of the market for loanable funds. This decrease in C and I dampens the effect of expansionary fiscal policy. This is seen in Figure 10.5 as a movement from AD1 to AD2 .

Figure 10.5

As we saw in Chapter 9 , if increases in AD continue into the upward-sloping range of AS, some of the multiplier effect of the fiscal policy is consumed by inflation, and thus it is less effective.

When the government is fighting inflation with contractionary policy, we are likely to see the opposite of the crowding out problem. If a budget surplus is the result of the contractionary policy, and government debt is retired, the demand for loanable funds decreases, interest rates fall and private investment increases (“crowding in,” perhaps), thus lessening the impact of contractionary fiscal policy.

Another Way of Looking at Crowding Out

There are two different ways to show how a government budget deficit affects the market for loanable funds and crowds out private investment. I know that can be frustrating, but, hey, that’s macro for you! Luckily, the outcomes are the same, and each approach is considered correct on the AP Macroeconomics exam.

The fundamental difference in these approaches is where the loanable funds model places the government. In the model presented, government borrowing (or saving, if there is a budget surplus) resides in the demand curve. Most textbooks use this approach. The demand curve represents the total of all of the private investing and borrowing (from firms) and public borrowing (from government). When the government has a budget deficit, the demand for loanable funds shifts to the right and the real interest rate rises. Private investment, the other source of the demand for loanable funds, decreases and is thus “crowded out.”

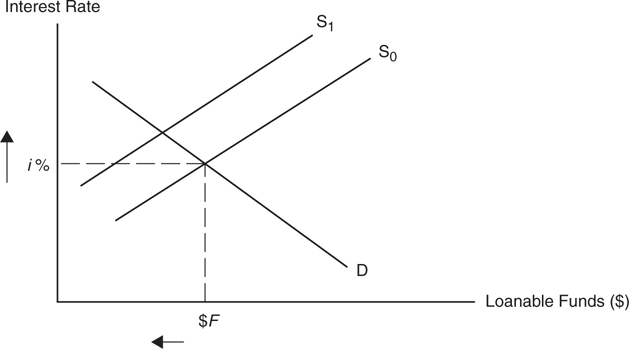

Other popular macroeconomics textbooks, including the one that your teacher probably chose to use, place the government in the supply curve. The supply curve represents the sum of both private saving (from households) and public saving from the government. If the government has a budget deficit, public saving is negative and the supply of loanable funds shifts leftward. If the government has a budget surplus, public saving is positive and the supply of loanable funds shifts rightward.

Suppose the government is running a budget deficit and public saving is negative. Figure 10.6 shows that a leftward shift of the supply curve increases the interest rate in the market for loanable funds and decreases the quantity of loanable funds both invested and saved.

Figure 10.6

So it doesn’t matter if your textbook (or teacher) treats crowding out as a leftward shift in supply of, or as a rightward shift in demand for, loanable funds. As long as you can see (or show) the impact of government budget deficits as a higher interest rate and lower private investment, you will score highly on those exam questions.

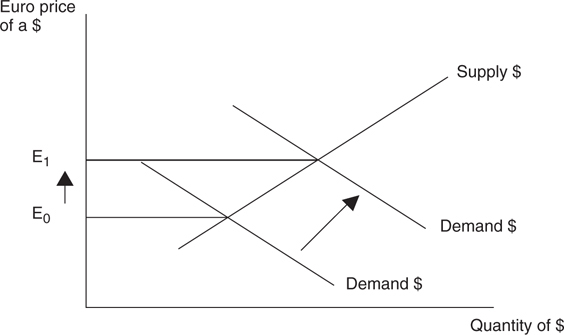

Net Export Effect

If the government is borrowing to conduct fiscal policy, the resulting increase in interest rates has a similar crowding out effect on net exports through foreign exchange rates. Again, this is a topic that is addressed in a later chapter, but the basics can be described here. If you are a German, a Malaysian, or a Brazilian and you see interest rates rising in the United States, this higher interest rate makes the United States an attractive place to invest your money and earn higher interest payments. However, you need dollars to purchase a U.S. security (e.g., a U.S. Treasury bond). The increased demand for dollars drives up the “price” of a dollar, which is measured in how many euros, ringgits, or reals it takes to buy a dollar on the currency market. The market for U.S. dollars is illustrated in Figure 10.7 , where the price is measured in the number of euros it takes to acquire one dollar.

Figure 10.7

“Don’t try to figure it out in your head. Draw the graphs and read your answers from them.”

—Nate, AP Student

When the price of a dollar rises from E0 to E1 , it now becomes more expensive for foreign citizens to buy goods made in the United States. All else equal, net exports in the United States fall when the dollar appreciates in value. Falling net exports decreases AD, which lessens the impact of the expansionary fiscal policy. This would be seen in much the same way as in Figure 10.5 .

If the government is using contractionary fiscal policy to fight inflation, and interest rates begin to fall, the demand for dollars falls, depreciating the dollar and increasing net exports. This increase in net exports lessens the effectiveness of the contractionary fiscal policy.

• Expansionary fiscal policy is less effective if government borrowing crowds out private investment with higher interest rates.

• Expansionary fiscal policy is less effective if net exports fall because of an appreciating dollar.

• These effects also work in the opposite direction, making contractionary fiscal policy less effective when interest rates fall.

State and Local Policies

The U.S. Constitution does not require that the federal government balance the budget and most economists would agree that this is a good thing. After all, when the economy is in a recession, tax revenues are going to be low and deficits are likely to occur. Balancing the budget requires a combination of higher taxes and less spending, which only exacerbates the recession! Likewise, during a period of economic expansion, tax revenues are high and surpluses occur. Balancing the budget requires lower taxes or higher levels of spending to eliminate the surplus, which continues the expansion and risks higher inflation rates.

On the other hand, many state and local governments are required by law to balance their budgets. During recessions, tax revenue collected by these levels of government fall and elected officials are required to increase taxes and make difficult decisions on which state and local programs need to be cut.

So while the federal government is cutting taxes to increase your disposable income and spur economic growth, your state and local governments are increasing your taxes to make up for the budgetary shortfalls caused by the very recession the federal government is trying to fix. Argh! In my state of Indiana, since 2001 citizens have seen a 1 percent increase in the sales tax, increases in property taxes, and, in the history of my county, the first ever county income tax. Meanwhile, programs like education, law enforcement, and transportation have seen cutbacks to help offset lost federal funds.

So, in summary:

• State and local governments that are sometimes required by law to balance their budgets can thwart federal fiscal policy.

10.3 Economic Growth and Productivity

Main Topics: Production Possibilities, Productivity, Determinants of Productivity, Supply-Side Policies

Production Possibilities

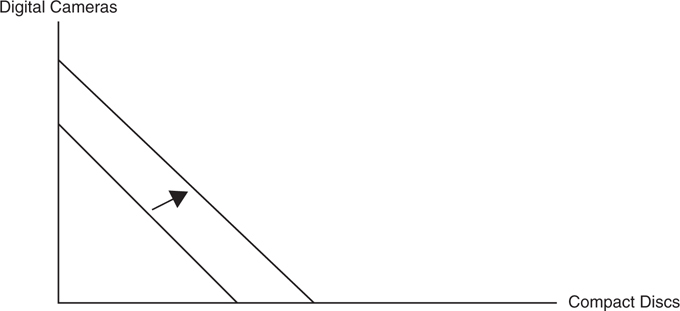

Way back in Chapter 5 , the topic of the PPF was introduced, and that chapter illustrated how the frontier can move outward over time. This simple graphical technique can be extremely useful and adaptable to seeing how growth can be impacted by government policy. Before we move on to policy, here is a quick refresher course in economic growth and productivity.

Figure 10.8 shows that this nation’s production possibilities in CDs and digital cameras can grow over time if

Figure 10.8

1. the quantity of economic resources increases,

2. the quality of those resources improves, and/or

3. the nation’s technology improves.

Productivity

The factors that shift a PPF outward over time make a lot of sense, but what they all have in common is that each has the potential to represent increased productivity . Productivity is typically described as measuring the quantity of output that can be produced per worker in a given amount of time. If a nation’s labor force can produce more output per worker from one year to the next, we say that productivity has increased and the nation’s PPF has shifted outward.

Determinants of Productivity

The determinants of productivity help to explain why some nations have grown at faster rates than other nations. This short list of determinants provides policy makers with a list of targets that can help to focus policy on factors that increase a nation’s growth rate.

Stock of Physical Capital

Workers are more productive when they have tools at their disposal. Try painting a house without a brush, digging a hole without a shovel, or writing a term paper without a personal computer, and you’ll find out how important tools can be to your productivity. The nice thing about increasing the quantity of physical capital in an economy is that, in many cases, the capital helps to increase the quantity of more capital. There should be policies that provide incentives to invest in physical capital. The supply-side policies described later in the chapter are examples of policies that can increase investment in physical capital.

Human Capital

Labor is a much more productive resource when it has more human capital . Human capital is the amount of knowledge and skills that labor can apply to the work that they do. An accountant who takes extra courses so that she can earn her stockbroker’s license has increased her human capital. A nurse who studies to become a physician’s assistant is increasing her human capital and becoming more productive. Human capital also includes the general health of the nation’s labor force. A labor force that has been vaccinated against debilitating disease can bring more productivity to the nation’s workplace than the labor force of a nation that has not received these vaccinations. There should be national policies that provide incentives to invest in human capital. How about subsidies to public education to decrease the price to households? Or low-interest federal student loans to help fund college? Or government agencies to research and promote the general physical and psychological health of the population?

Natural Resources

Productive resources provided by nature are called natural resources. A nation’s stocks of minerals, fertile soil, timber, or navigable waterways contribute to productivity. Nonrenewable resources, such as oil and coal, have a finite supply and cannot replenish themselves. Renewable resources, such as timber and salmon, have the ability to repopulate themselves. Environmental protection laws are designed to maintain the quality of natural resources, so the productivity does not rapidly depreciate.

Technology

Technology is thought of as a nation’s knowledge of how to produce goods in the best possible way. Imagine the technological leap that was made when humankind created fire, or the wheel, or the radio, or the assembly line, or the pizza crust with cheese in the middle. Amazing stuff! There should be policies that provide incentives to increase the rate of technological progress. The government’s provision of research grants to university professors and laboratories helps to further our state of technology.

What Do All of These Productivity Determinants Have in Common?

They all require an investment, and funds for investment come from saving . Firms invest in physical capital and individuals invest in human capital. Nations invest in the conservation of their natural resources, and entrepreneurs invest in technological research. “Productivity-friendly” policies should make it easier to invest, easier to save, or both. Some economists believe that supply-side policies have the potential to increase productivity, and therefore economic growth.

Supply-Side Policies

So far the discussion of fiscal policy is centered on changing government spending and/or taxing to expand or contract AD as a way to move the economy closer to full employment. Other economists believe that the government’s fiscal policy should not be so proactive in manipulation of AD. These economists advocate a government that is more hands-off when it comes to fiscal policy. These economists believe that the economy generally moves to full employment without government intervention, but if the government does get involved, fiscal policy should focus on, or at least strongly consider, the AS half of the equation by providing incentives to increase saving and investment. The main idea behind supply-side fiscal policy is that tax reductions targeted to AS increase AS so that real GDP increases with very little inflation. This was our “best of all possible macroeconomic situations” from the previous chapter.

Saving and Investment

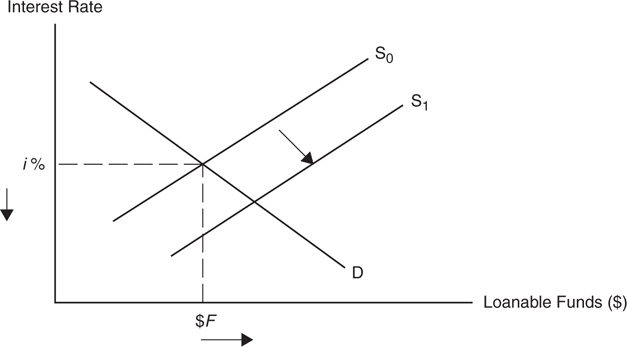

Supply-side proponents would suggest policies that lower, or remove, taxes on income earned from savings. This would encourage saving and increase the supply of loanable funds, decrease the real interest rate, and increase the amount of money that firms invest. Figure 10.9 shows an increase in the supply of loanable funds. These economists would also propose an investment tax credit , which reduces a firm’s taxes if it invests in physical capital.

Figure 10.9

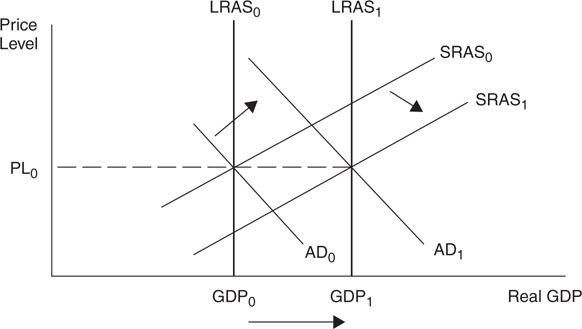

Lower income taxes increase disposable income for households, increase both consumption and savings from households, and increase the profitability of investment for firms. This increase in saving and investment allows for an increase in the productive capacity of a nation because more capital stock is accumulated. Ideally, this increase in investment increases the long-run AS curve. The increase in long-run AS is illustrated in Figure 10.10 . Tax incentives to increase saving and investment on the supply side are likely to also increase AD. (Note: The price level is shown to remain constant, but this does not have to be, depending upon the magnitudes of the two curves’ shifts.)

Figure 10.10

Though not all economists completely agree with their effectiveness, supply-side economists typically advocate other explanations for how lower taxes can increase AS as well as AD:

• Productivity incentives . Lower taxes mean workers take more of their pay home, which might prompt wage earners to work harder, take less time off, and be more productive. How hard would you work if 90 percent of your pay were lost to the taxman? People not currently in the workforce seek employment at lower tax rates. If the government has a large role in social programs, citizens learn to rely on the government and do less on their own.

• Risk taking . Entrepreneurs take big risks to start businesses and invest in new capital. Lowering the tax rate on profits increases the expected rate of return and encourages more investment.

![]() Review Questions

Review Questions

1 . Which of the following would not be an example of contractionary fiscal policy?

(A) Decreasing money spent on social programs

(B) Increasing income taxes

(C) Canceling the annual cost of living adjustments to the salaries of government employees

(D) Increasing money spent to pay for government projects

(E) Doing nothing with a temporary budget surplus

2 . In a long period of economic expansion the tax revenue collected ____ and the amount spent on welfare programs ____, creating a budget ____ .

(A) increases, decreases, surplus

(B) increases, decreases, deficit

(C) decreases, decreases, surplus

(D) decreases, increases, deficit

(E) increases, increases, surplus

3 . The crowding-out effect from government borrowing is best described as

(A) the rightward shift in AD in response to the decreasing interest rates from contractionary fiscal policy.

(B) the leftward shift in AD in response to the rising interest rates from expansionary fiscal policy.

(C) the effect of the President increasing the money supply, which decreases real interest rates, and increases AD.

(D) the effect on the economy of hearing the chairperson of the central bank say that he or she believes that the economy is in a recession.

(E) the lower exports due to an appreciating dollar versus other currencies.

4 . Which of the following fiscal policies is likely to be most effective when the economy is experiencing an inflationary gap?

(A) The government decreases taxes and keeps spending unchanged.

(B) The government increases spending and keeps taxes unchanged.

(C) The government increases spending matched with an increase in taxes.

(D) The government decreases spending and keeps taxes unchanged.

(E) The government increases taxes and decreases spending.

5 . Which of the following would likely slow a nation’s economic growth?

(A) Guaranteed low-interest loans for college students

(B) Removal of a tax on income earned on saving

(C) Removal of the investment tax credit

(D) More research grants given to medical schools

(E) Conservation policies to manage the renewable harvest of timber

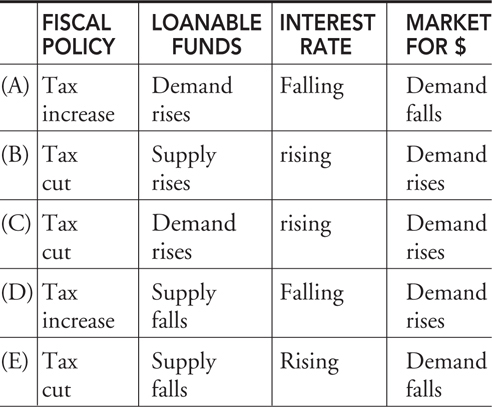

6 . The U.S. economy currently suffers a recessionary gap, and a budget deficit exists. If the government wishes to fix the recession, which of the following choices best describes the appropriate fiscal policy, the impact on the market for loanable funds, the interest rate, and the market for the U.S. dollar?

![]() Answers and Explanations

Answers and Explanations

1 . D —This is expansionary policy, and the others either contract the economy or do nothing.

2 . A —In an expansion, households should earn more income, which increases the taxes paid to the government. At the same time, people who needed welfare, or other government assistance, do not need it now because the unemployment level is low and wages are high. In this time of prosperity, the government should run a budget surplus.

3 . B —If the government borrows to expand the economy, interest rates rise, thus crowding out private investors. This shifts AD leftward, weakening the fiscal policy impact.

4 . E —Real GDP is at a level above full employment, so AD must be shifted leftward. Choice D shifts AD to the left and lessens the inflationary gap, but choice E couples higher taxes with lower spending and therefore is the most effective remedy. All other choices increase AD and worsen the inflationary gap.

5 . C —An investment tax credit rewards firms that invest in physical assets. Removal of this tax credit slows investment, productivity, and growth. All other policies would increase the productivity of resources or increase technological innovation.

6 . C —When a recessionary gap exists, the appropriate fiscal policy is to cut taxes and run an even larger budget deficit. The borrowing necessary to pay for a budget deficit increases the demand for loanable funds and increases the interest rate. Rising interest rates create a stronger demand for the U.S. dollar because U.S. Treasury bondholders are receiving more interest income. Knowing that the economy is in a recession allows you to quickly eliminate all tax increases.

![]() Rapid Review

Rapid Review

Fiscal policy: Deliberate changes in government spending and net tax collection to affect economic output, unemployment, and the price level. Fiscal policy is typically designed to manipulate AD to “fix” the economy.

Expansionary fiscal policy: Increases in government spending or lower net taxes meant to shift the aggregate expenditure function upward and shift AD to the right.

Contractionary fiscal policy: Decreases in government spending or higher net taxes meant to shift the aggregate expenditure function downward and shift AD to the left.

Sticky prices: If price levels do not change, especially downward, with changes in AD, then prices are thought of as sticky or inflexible. Keynesians believe the price level does not usually fall with contractionary policy.

Budget deficit: Exists when government spending exceeds the revenue collected from taxes.

Budget surplus: Exists when the revenue collected from taxes exceeds government spending.

Automatic stabilizers: Mechanisms built into the tax system that automatically regulate, or stabilize, the macroeconomy as it moves through the business cycle by changing net taxes collected by the government. These stabilizers increase a deficit during a recessionary period and increase a budget surplus during an inflationary period, without any discretionary change on the part of the government.

Crowding-out effect: When the government borrows funds to cover a deficit, the interest rate increases and households and firms are crowded out of the market for loanable funds. The resulting decrease in C and I dampens the effect of expansionary fiscal policy.

Net export effect: A rising interest rate increases foreign demand for U.S. dollars. The dollar then appreciates in value, causing net exports from the United States to fall. Falling net exports decreases AD, which lessens the impact of the expansionary fiscal policy. This is a variation of crowding out.

Productivity: The quantity of output that can be produced per worker in a given amount of time.

Human capital: The amount of knowledge and skills that labor can apply to the work that they do and the general level of health that the labor force enjoys.

Nonrenewable resources: Natural resources that cannot replenish themselves. Coal is a good example.

Renewable resources: Natural resources that can replenish themselves if they are not overharvested. Lobster is a good example.

Technology: A nation’s knowledge of how to produce goods in the best possible way.

Investment tax credit: A reduction in taxes for firms that invest in new capital like a factory or piece of equipment.

Supply-side fiscal policy: Fiscal policy centered on tax reductions targeted to AS so that real GDP increases with very little inflation. The main justification is that lower taxes on individuals and firms increase incentives to work, save, invest, and take risks.