5 Steps to a 5: AP Macroeconomics 2017 (2016)

STEP 5

Build Your Test-Taking Confidence

AP Macroeconomics Practice Exam 2

Section I: Multiple-Choice Questions

ANSWER SHEET

AP Macroeconomics Practice Exam 2, Section I

Multiple-Choice

Time —1 hour and 10 minutes

60 questions

For the multiple-choice questions that follow, select the best answer and fill in the appropriate letter on the answer sheet.

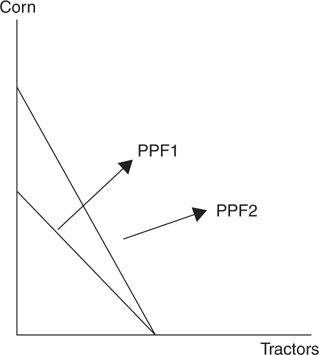

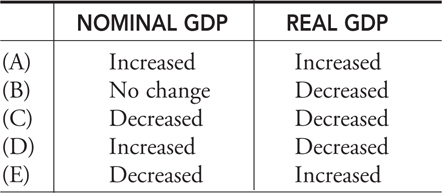

Questions 1 and 2 refer to the figure below.

1 . Suppose that the production possibility frontier (PPF) of this nation moves from PPF1 to PPF2. Which of the following could be the cause of this movement?

(A) Technological improvements in the production of tractors

(B) A long-lasting and destructive drought

(C) A more efficient use of steel, an important raw material in the production of tractors

(D) An economy-wide improvement in the productivity of the labor force

(E) More effective pesticides used to protect crops from insect damage

2 . Now that the economy is operating on PPF2, what has happened to the opportunity cost of producing these goods?

(A) The opportunity cost of producing tractors has decreased, while the opportunity cost of producing corn has increased.

(B) The opportunity cost of producing tractors has increased, while the opportunity cost of producing corn has decreased.

(C) The opportunity costs of producing tractors and corn have both decreased.

(D) There has been no change in the opportunity cost of producing tractors and corn.

(E) The opportunity costs of producing tractors and corn have both increased.

3 . The price of gasoline has recently increased, while at the same time gasoline consumption has also increased. What is happening in the gasoline market?

(A) This is evidence that contradicts the law of demand.

(B) The price of crude oil has fallen, shifting the supply of gasoline to the right.

(C) A price ceiling has been imposed in the market for gasoline.

(D) The price of automobiles has increased, shifting the demand for gasoline to the left.

(E) Consumers prefer larger automobiles, shifting the demand for gasoline to the right.

4 . If Nation A can produce a good at lower opportunity cost than Nation B can produce the same good, it is said that

(A) Nation A has comparative advantage in the production of that good.

(B) Nation B has comparative advantage in the production of that good.

(C) Nation A has absolute advantage in the production of that good.

(D) Nation B has absolute advantage in the production of that good.

(E) Nation A has economic growth in the production of that good.

5 . Which of the following is a consequence of removal of a protective tariff on imported steel?

(A) Imports fall.

(B) Income is transferred from steel consumers to domestic steel producers.

(C) Income is transferred from foreign steel producers to domestic steel producers.

(D) Allocative efficiency is improved.

(E) Aggregate supply is decreased.

6 . In the last 20 years, firms that produce cameras have begun to produce fewer 35-mm cameras and more digital cameras. This trend is an example of

(A) how central planners dictate which cameras are produced.

(B) the market system answering the question of “how” cameras should be produced.

(C) the market system answering the question of “what” cameras should be produced.

(D) the market system answering the question of “who” should consume the cameras that are produced.

(E) how firms fail to respond to improvements in technology and changes in consumer tastes.

7 . Which of the following transactions would be included in the official computation of gross domestic product?

(A) Josh buys a new pair of running shoes.

(B) Nancy offers to babysit her granddaughter.

(C) Max buys his dad’s used car.

(D) Eli cannot go to a concert, so he resells his ticket to a friend.

(E) Melanie rakes the leaves in her own yard.

8 . Theo loses his job at the public swimming pool when the pool closes for the winter. This is an example of

(A) cyclical unemployment.

(B) discouraged worker.

(C) seasonal unemployment.

(D) frictional unemployment.

(E) structural unemployment.

9 . Which of the following is not a scarce economic resource?

(A) Labor

(B) Capital

(C) Human wants

(D) Land

(E) Natural resources

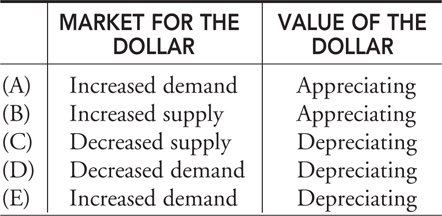

10 . How does an increasing national debt impact the market for U.S. dollars and the value of the dollar with respect to other currencies?

11 . Suppose the price level in the United States has risen in the past year, but production of goods and services has remained constant. Based on this information, which of the following is true?

12 . Which of the following is not an addition to national income?

(A) Wages

(B) Salaries

(C) Interest

(D) Depreciation of physical capital

(E) Profits

13 . Which choice produces a faster rate of economic growth for the United States?

(A) Institution of higher tariffs on imported goods

(B) More investment in capital infrastructure and less consumption of nondurable goods and services

(C) Elimination of mandatory school attendance laws

(D) Annual limits on the number of foreigners immigrating into the United States

(E) More investment in the military and less investment in higher education

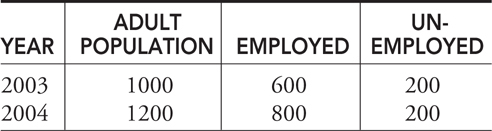

14 . The table above summarizes the local labor market. Based on this information, which of the following is an accurate statement?

(A) The number of discouraged workers has fallen from 2003 to 2004.

(B) Although the population has grown, the labor force has remained constant from 2003 to 2004.

(C) The unemployment rate fell from 33 percent in 2003 to 25 percent in 2004.

(D) The economic recession in 2003 worsened in 2004.

(E) The unemployment rate fell from 25 percent in 2003 to 20 percent in 2004.

15 . Which of the following is true of money and financial markets?

(A) As the demand for bonds increases, the interest rate increases.

(B) For a given money supply, if nominal GDP increases, the velocity of money decreases.

(C) When demand for stocks and bonds increases, the asset demand for money falls.

(D) A macroeconomic recession increases the demand for loanable funds.

(E) Equilibrium in the money market occurs where the transaction demand for money equals the supply of money.

16 . Which of the following would increase the aggregate demand function?

(A) Higher levels of imported goods

(B) Lower levels of consumer wealth

(C) A higher real interest rate

(D) Lower taxes on personal income

(E) Lower levels of exported goods

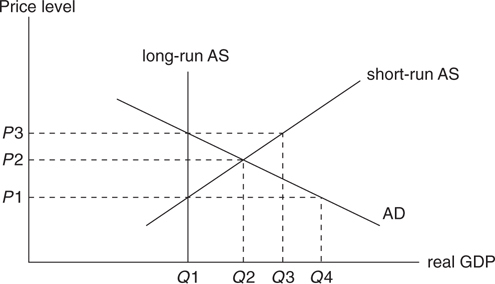

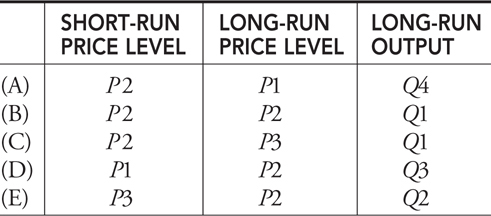

17 . The figure above shows aggregate demand (AD) and supply (AS) for the economy. Assuming that aggregate demand remains constant, which of the following best predicts the short-run price level, the long-run price level, and the long-run level of output?

18 . Which of the following is not included in the U.S. GDP?

(A) The U.S. military opens a new base in a foreign country with 1,000 U.S. personnel.

(B) Japanese consumers buy thousands of CDs produced in the United States.

(C) An American pop singer performs a sold-out concert in Paris.

(D) A French theatrical production tours dozens of American cities.

(E) American construction companies build thousands of new homes all across the United States and Canada.

19 . A policy supported by supply-side economists would be

(A) higher taxes on corporate profits.

(B) lower tax rates on interest earned from savings.

(C) removal of investment tax credits.

(D) a longer duration of unemployment benefits.

(E) higher marginal income tax rates to fund social welfare programs.

20 . According to the quantity theory of money, increasing the money supply serves to

(A) stimulate short-run production and employment with very little long-run inflation.

(B) increase short-run output, but it is the source of long-run inflation.

(C) lower the unemployment rate while also lowering the rate of inflation.

(D) increase the nation’s long-run capacity to produce.

(E) decrease short-run real GDP but increase real GDP in the long run.

21 . Of the following choices, the most direct exchange in the circular flow model of a private closed economy is when

(A) households provide goods to firms in exchange for wage payments.

(B) households provide resources to firms in exchange for goods.

(C) households provide revenues to firms in exchange for wage payments.

(D) firms supply goods to households in exchange for revenues.

(E) firms supply resources to households in exchange for costs of production.

22 . Suppose that the federal government reclassified the purchase of a new home as consumption spending rather than investment spending. This decision would

(A) increase aggregate demand and decrease real GDP.

(B) decrease aggregate demand and decrease real GDP.

(C) decrease aggregate demand and increase real GDP.

(D) increase aggregate demand and increase real GDP.

(E) have no impact on aggregate demand and real GDP.

23 . Suppose that current disposable income is $10,000 and consumption spending is $8,000. For every $100 increase in disposable income, saving increases $10. Given this information,

(A) the marginal propensity to consume is .80.

(B) the marginal propensity to save is .20.

(C) the marginal propensity to save is .10.

(D) the marginal propensity to save is .90.

(E) the marginal propensity to consume is .10.

24 . When we observe an unplanned decrease in inventories, we can expect

(A) prices to begin to fall.

(B) output to begin to rise.

(C) saving to begin to fall.

(D) output to begin to fall.

(E) planned investment to begin to rise.

25 . Stagflation is the result of

(A) a leftward shift in the aggregate supply curve.

(B) a leftward shift in the aggregate demand curve.

(C) a leftward shift in both the aggregate supply and aggregate demand curves.

(D) a rightward shift in the aggregate supply curve.

(E) a rightward shift in the aggregate demand curve.

26 . If the short-run aggregate supply curve is horizontal, it is because

(A) there exist many unemployed resources so that output can be increased without increasing wages and prices.

(B) any increase in output requires a corresponding increase in wages and prices.

(C) increases in output cause prices to increase, but wages adjust much less quickly.

(D) falling interest rates increase the demand for goods and services, putting upward pressure on prices.

(E) resources are fully employed so that output can be increased but only if the price level also increases.

27 . In a private closed economy, which of the following statements is true?

(A) Household saving can never be negative.

(B) Investment is always greater than savings.

(C) The economy is in equilibrium when consumption equals saving.

(D) Saving is equal to zero when consumption equals disposable income.

(E) Government is the only source of spending and investment.

28 . Which of the following is true of a typical contraction of the business cycle?

(A) Consumption is falling, but household wealth is rising.

(B) Consumption is increasing.

(C) Private investment is rising.

(D) Employment and inflation are low.

(E) Private saving rates are rising.

29 . Which of the following is most likely to produce stronger economic growth over time?

(A) More rapid consumption of natural resources.

(B) Higher adult illiteracy rates.

(C) A falling stock of capital goods.

(D) Investment tax credits.

(E) Higher taxes on foreign capital investment.

30 . If $100 of new autonomous private investment were added to an economy with a marginal propensity to consume of .90, by how much would aggregate demand shift to the right?

(A) $190

(B) $900

(C) $1,000

(D) $1,900

(E) $90

31 . Which of the following is true about the relationship between the M 1 and M 2 measures of money?

(A) M 1 minus M 2 equals 0.

(B) M 1 includes checking deposits, while M 2 includes checking and saving deposits.

(C) M 2 includes coin and paper money, but M 1 does not.

(D) M 2 is more liquid than M 1.

(E) M 1 is greater than M 2.

32 . Which of the following increases the size of the tax multiplier?

(A) An increase in the marginal propensity to consume.

(B) An increase in the reserve ratio.

(C) An increase in the marginal propensity to save.

(D) A decrease in the spending multiplier.

(E) A decrease in the velocity of money.

33 . Which of the following might worsen a nation’s trade deficit?

(A) Lower wages relative to other nations.

(B) Lower taxes on corporate profits relative to other nations.

(C) A higher interest rate on financial assets relative to other nations.

(D) A higher rate of inflation relative to other nations.

(E) Other nations remove tariffs and quotas on foreign imports.

34 . If the economy is suffering from extremely high rates of inflation, which of the following fiscal policies would be an appropriate strategy for the economy?

(A) Increase government spending and decrease taxes.

(B) Decrease government spending and increase taxes.

(C) Increase government spending with no change in taxes.

(D) The Federal Reserve increases the discount rate.

(E) Decrease taxes with no change in government spending.

35 . Which of the following is an example of an expansionary supply shock?

(A) Rapid increasing wages

(B) A greatly depreciated currency

(C) Declining labor productivity

(D) Lower than expected agricultural harvests

(E) Lower factor prices in major industries

36 . Which of the following fiscal policy combinations would be most likely to slowly increase real GDP without putting tremendous upward pressure on the price level?

(A) Increase government spending with a matching decrease in taxes.

(B) Decrease government spending with a matching increase in taxes.

(C) Increase government spending with no change in taxes.

(D) The Federal Reserve lowers the reserve ratio.

(E) Increase taxes with a matching increase in government spending.

37 . Which of the following is an example of contractionary monetary policy?

(A) The Fed lowers the reserve ratio.

(B) The Fed lowers the discount rate.

(C) The Fed increases taxes on household income.

(D) The Fed decreases spending on welfare programs.

(E) The Fed sells Treasury securities to commercial banks.

38 . The economy is in a deep recession. Given this economic situation, which of the following statements about monetary policy is accurate?

(A) Expansionary policy would only worsen the recession.

(B) Expansionary policy greatly increases aggregate demand if investment is sensitive to changes in the interest rate.

(C) Contractionary policy is the appropriate stimulus for investment and consumption.

(D) If the demand for money is perfectly elastic, expansionary monetary policy might be quite effective.

(E) An open market operation that sells government securities is the only realistic way to improve the economy.

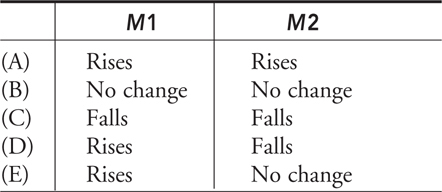

39 . Daddy Morebucks withdraws $1 million from his savings account and puts the cash in his refrigerator. This affects M 1 and M 2 in which of the following ways?

40 . What is the main difference between the short-run and long-run Phillips curve?

(A) The short-run Phillips curve is downward sloping and the long-run Phillips curve is upward sloping.

(B) The short-run Phillips curve is upward sloping and the long-run Phillips curve is vertical.

(C) The short-run Phillips curve is horizontal and the long-run Phillips curve is upward sloping.

(D) The short-run Phillips curve is downward sloping and the long-run Phillips curve is vertical.

(E) The short-run Phillips curve is vertical and the long-run Phillips curve is upward sloping.

41 . Which of the following insures the value of the U.S. dollar?

(A) The euro and other foreign currencies held by the Federal Reserve

(B) Gold bars in secure locations like Fort Knox

(C) The promise of the U.S. government to maintain its value

(D) The value of the actual paper on which it is printed.

(E) An equal amount of physical capital, land, and natural resources

42 . The reserve ratio is .10 and Mommy Morebucks withdraws $1 million from her checking account and keeps it as cash in her refrigerator. How does this withdrawal potentially impact money in circulation?

(A) Decreases it by $9 million

(B) Decreases it by $1 million

(C) Decreases it by $100,000

(D) Increases it by $1 million

(E) Decreases it by $10 million

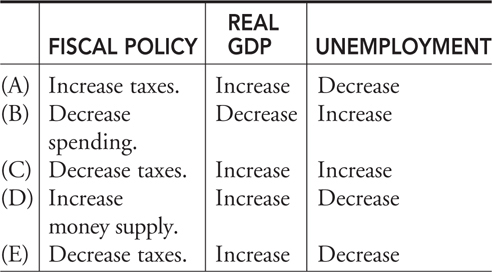

43 . If the economy were experiencing a recessionary gap, choose the option below that would be an appropriate fiscal policy to eliminate the gap, and the predicted impact of the policy on real GDP and unemployment.

44 . Monetary tools of the Federal Reserve do not include which of the following choices?

(A) Buying Treasury securities from commercial banks

(B) Changing tariffs and quotas on imported goods

(C) Changing the reserve ratio

(D) Changing the discount rate

(E) Selling Treasury securities to commercial banks

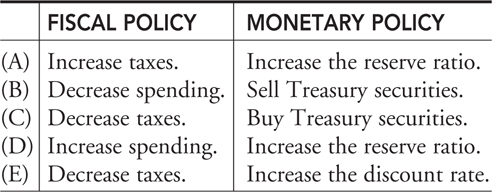

45 . Of the following choices, which combination of fiscal and monetary policy would most likely reduce a recessionary gap?

46 . For a given level of government spending, the federal government usually experiences a budget____during economic____and a budget ______during economic_______.

(A) deficit, recession, surplus, expansion

(B) surplus, recession, deficit, expansion

(C) deficit, expansion, surplus, recession

(D) surplus, recession, surplus, expansion

(E) deficit, recession, deficit, expansion

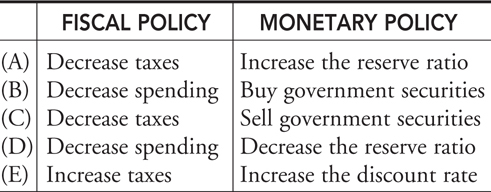

47 . Suppose that elected officials and the central bank agree to combine fiscal and monetary policies to lessen the threat of inflation. Which of the following combinations would likely accomplish this goal?

48 . Congress has embarked on another round of expansionary fiscal policy to boost employment and get reelected. As chair of the central bank, how would you reduce the “crowding-out” effect and what macroeconomic problem might your policy exacerbate?

(A) Increase the reserve ratio, risking the devaluation of the dollar

(B) Sell government securities, risking inflation

(C) Buy government securities, risking a recessionary gap

(D) Lower the discount rate, risking inflation

(E) Lower the discount rate, risking cyclical unemployment

49 . Which of the following is likely to shift the long-run aggregate supply curve to the right?

(A) A nation that devotes more resources to nondurable consumption goods, rather than durable capital goods

(B) Research that improves the productivity of labor and capital

(C) More restrictive trade policies

(D) Annual limits to immigration of foreign citizens

(E) A permanent increase in the price of energy

50 . Holding all else equal, which of the following monetary policies would be used to boost U.S. exports?

(A) Increasing the discount rate

(B) Increasing the reserve ratio

(C) Buying government securities

(D) Lowering tariffs

(E) Removing import quotas

51 . Which of the following could limit the ability of a central bank to conduct expansionary monetary policy?

(A) Money demand is nearly perfectly elastic.

(B) Investment demand is nearly perfectly elastic.

(C) Banks make loans with all excess reserves.

(D) Households carry very little cash, holding their money in checking and saving deposits.

(E) Money supply is nearly perfectly inelastic.

52 . Which of the following is a predictable advantage of expansionary monetary policy in a recession?

(A) It decreases aggregate demand so that the price level falls, which increases demand for the dollar.

(B) It increases investment, which increases aggregate demand and increases employment.

(C) It increases aggregate demand, which increases real GDP and increases the unemployment rate.

(D) It keeps interest rates high, which attracts foreign investment.

(E) It decreases the interest rate, which attracts foreign investment in U.S. financial assets.

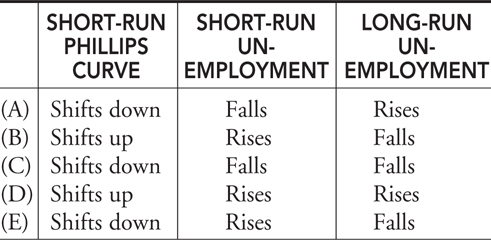

53 . Suppose the economy is in long-run equilibrium when a temporary expansionary supply shock is felt in the economy. This changes the short-run Phillips curve, the short-run unemployment rate, and the long-run unemployment rate in which of the following ways?

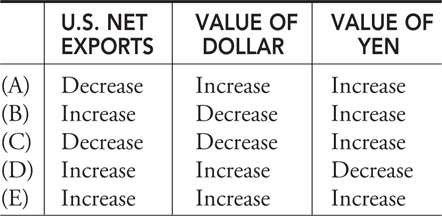

54 . As the Japanese economy expands, in what ways do U.S. net exports, the values of the dollar and the yen change?

55 . Suppose the President plans to cut taxes for consumers and also plans to increase spending on the military. How does this affect real GDP and the price level?

(A) GDP increases and the price level decreases.

(B) GDP decreases and the price level increases.

(C) GDP stays the same and the price level increases.

(D) GDP decreases and the price level decreases.

(E) GDP increases and the price level increases.

56 . U.S. dollars and the European Union’s (EU’s) euro are exchanged in global currency markets. Which of the following is true?

(A) If inflation is high in the EU and the price level in the United States is stable, the value of the dollar appreciates.

(B) If the Fed decreases the money supply, the value of the dollar depreciates.

(C) If EU consumers are less inclined to purchase American goods, the dollar appreciates.

(D) If U.S. income levels are rising relative to incomes in the EU, the euro depreciates.

(E) If the European central bank expands the money supply, the euro appreciates.

57 . If in a given year the government collects more money in net taxes than it spends, there would exist

(A) a current account deficit.

(B) a budget surplus.

(C) a trade surplus.

(D) a budget deficit.

(E) a trade deficit.

58 . Which component of a nation’s balance of payments recognizes the purchase and sale of real and financial assets between nations?

(A) The capital account

(B) The official reserves account

(C) The current account

(D) The trade deficit account

(E) The trade surplus account

59 . An import quota on foreign automobiles is expected to

(A) increase domestic efficiency and protect domestic producers at the expense of foreign producers.

(B) decrease the price of automobiles and protect domestic consumers at the expense of foreign producers.

(C) increase the price of automobiles and protect domestic producers at the expense of consumers.

(D) increase the price of automobiles and protect domestic consumers at the expense of domestic producers.

(E) decrease domestic efficiency and protect domestic producers at the expense of domestic autoworkers.

60 . When a large increase in aggregate demand has an even greater increase in real GDP, economists refer to this as

(A) the balanced budget multiplier.

(B) the money multiplier.

(C) the foreign substitution effect.

(D) the wealth effect.

(E) the spending multiplier.

![]() Answers and Explanations

Answers and Explanations

1 . E —The capacity to produce corn has increased, but the capacity for tractor production is the same. More effective pesticides do not improve the ability to produce tractors but improve the ability to harvest corn.

2 . B —When the slope of the PPF increases, the opportunity cost of producing the x axis good rises.

3 . E —Rising prices and rising quantities does not disprove the law of demand; it simply reflects a rightward shift in demand with a constant supply curve.

4 . A —Defines comparative advantage.

5 . D —Tariffs create inefficiency in the world steel market.

6 . C —The free market responds to changes in consumer tastes, technology, and prices to produce “what” is most wanted by society.

7 . A —Household production is not included in GDP calculations. Second-hand sales are counted the first time the good was produced.

8 . C —Know the difference between types of unemployment.

9 . C —Human wants are neither scarce nor are they economic resources.

10 . A —Rising national debt increases interest rates and attracts foreign investment in U.S. financial assets. Greater demand for dollars appreciates the dollar.

11 . D —Nominal GDP rises with the price level. If output increases at a slower rate than increases in the price level, real GDP falls.

12 . D —National income includes all sources of income and depreciation is not a source of income.

13 . B —Know the factors critical to long-term economic growth.

14 . E —UR = U/LF and LF = (E + U).

15 . C —Stocks, bonds, and money are all financial assets. All else equal, rising demand for stocks and bonds lowers the asset demand for money.

16 . D —Lower taxes on personal income increase consumption and AD.

17 . C —Short-run equilibrium is where short-run AS intersects AD, in this case, above full employment. In the long run, wages increase, shifting SRAS leftward until settling at full employment Q 1 and higher price P 3 .

18 . C —GDP includes all production or spending done in the United States, regardless of nationality. A singer’s production of a concert is counted in French GDP.

19 . B —Supply-side economists prefer lower taxes on saving to encourage saving. More saving increases investment and increases AS.

20 . B —The equation of exchange says MV = PQ, and it is assumed that Q and V are fairly constant. Any increase in money supply (M ) might initially boost output, but it eventually results in a higher price level (P ).

21 . D —Know the circular flow model.

22 . E —This reclassification would not affect AD or tabulation of GDP.

23 . C —If income increases $100 and saving increases by $10, the MPS = .10 and the MPC = .90.

24 . B —If inventories unexpectedly fall, consumption exceeds production, so expect production to begin rising.

25 . A —Stagflation is inflation with high unemployment, and this occurs when AS shifts to the left.

26 . A —The horizontal range of SRAS occurs when resources are unemployed. If output rises, wages do not rise and prices are constant.

27 . D —Consumption spending is equal to disposable income minus saving: C = DI – S .

28 . D —Weak AD (contraction) causes job loss and low inflation rates.

29 . D —Investment tax credits provide incentives for firms to invest in capital equipment and new factory construction. This policy stimulates economic growth and productivity.

30 . C —With an MPC = .90, M = 10, so increased investment shifts AD $1,000 to the right.

31 . B —Remember, M 2 includes M 1 but also includes less liquid forms of money like savings accounts. If you added M 1 and M 2, you would be adding M 1 twice.

32 . A —Tm = M × MPC. A larger MPC increases the size of Tm.

33 . D —Higher inflation to other nations causes goods to be more expensive relative to those produced abroad, causing a drop in net exports.

34 . B —High inflation rates require a decrease in AD, and this is the only contractionary fiscal policy. Fed policy is not fiscal; it is monetary.

35 . E —Lower factor prices in major industries represent decreased costs of production, and this creates an increased SRAS.

36 . E —This balanced budget policy increases real GDP at a slower rate than the other expansionary options.

37 . E —Selling securities pulls excess reserves out of the banking system, decreasing the money supply.

38 . B —Expansionary policy lowers interest rates and is more effective if investment increases greatly. If money demand is perfectly elastic, increased money supply does not lower interest rates, thus failing to stimulate investment.

39 . E —Moving money from savings to cash increases M 1, but both savings and cash are already included in M 2, so it has no effect on these two larger measures of money.

40 . D —The short-run Phillips curve portrays the inverse relationship between inflation and unemployment rates. In the long run, it is vertical at the natural rate of unemployment.

41 . C —The U.S. dollar is not “backed” by any physical asset or commodity.

42 . A —The money multiplier is 10, so withdrawing $1 million leads you to conclude that money in circulation falls by $10 million, but the original $1 million is still in circulation, so money falls by $9 million.

43 . E —Know how fiscal policy affects real GDP and unemployment.

44 . B —The Fed does not make changes in tariff and quota policy.

45 . C —Have a strong knowledge of fiscal and monetary policies.

46 . A —Budget deficits emerge during recessions because net taxes fall when incomes fall. The trend is reversed during expansion.

47 . E —Know all combinations of fiscal and monetary policy.

48 . D —The central bank wants to increase the money supply to lower interest rates. Combine the expansionary fiscal with the expansionary monetary policy, and the bank risks inflation.

49 . B —Long-run AS rises if the productive capacity of the economy rises and more productive labor and capital resources have this effect.

50 . C —Lower interest rates decrease foreign demand for U.S. securities, depreciating the dollar. “Cheap” dollars make U.S. exports more affordable to foreigners, increasing exports.

51 . A —A horizontal money demand curve implies that increasing the money supply does not lower the interest rate. Investment is constant, and AD does not increase.

52 . B —Know how monetary policy affects investment, AD, and employment.

53 . A —If short-run AS shifts rightward, the short-run Phillips curve shifts down, or leftward. The short-run unemployment rate falls below the natural rate but eventually rises back to the natural rate and a lower rate of inflation, as expectations readjust to the new AS.

54 . D —Higher Japanese incomes increase net exports in the United States, increasing the value of the dollar versus the yen, decreasing the value of the yen versus the dollar.

55 . E —Know how fiscal policy affects AD, real GDP, and the price level.

56 . A —A difference in relative prices affects the exchange rate between the dollar and the euro. European customers will see U.S. goods as relatively less expensive and increase their purchases from the United States, thus appreciating the dollar and depreciating the euro.

57 . B —This defines a budget surplus.

58 . A —In the balance of payments statement, the capital account shows the flow of currency in physical and financial assets.

59 . C —Import quotas protect domestic producers at the expense of the higher price paid by consumers.

60 . E —Because an injection of dollars into the circular flow goes through the economy several times, the impact on real GDP is multiplied.

AP Macroeconomics Practice Exam 2, Section II

Free-Response Questions

Planning time —10 minutes

Writing time —50 minutes

At the conclusion of the planning time, you have 50 minutes to respond to the following three questions.

Approximately half of your time should be given to the first question, and the second half should be divided evenly between the remaining two questions. Be careful to clearly explain your reasoning and to provide clear labels to all graph axes and curves.

1 . The U.S. economy is experiencing a severe recession, and the budget is currently balanced.

(A) One policy analyst advocates expansionary tax cuts, while another advocates expansionary government spending. Which of these policies will have the greatest impact on real domestic output? Explain how you know.

(B) Choose one of the two proposed policies in part (A).

i. Based on this policy, will the federal budget be in a deficit, in a surplus, or balanced?

ii. Based on your response to (B)(i), state what happens to interest rates in the market for loanable funds. Explain.

(C) Assuming that the economy has still not recovered from the recession, identify one tool of the Federal Reserve that might stimulate the economy.

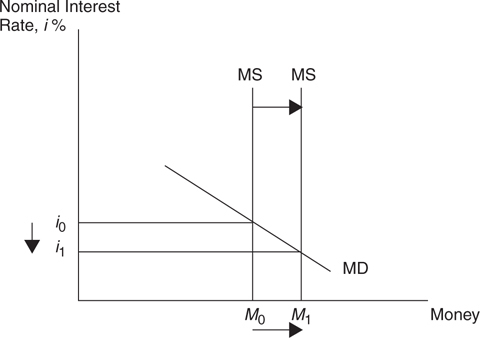

(D) Using a correctly labeled graph of the money market, show how the Fed policy identified in part (C) would affect interest rates.

(E) Explain one factor that might lessen the effectiveness of the Fed’s monetary policy.

2. Assume that the European Union (EU) has experienced lower interest rates, while interest rates in the United States have remained relatively high. Explain how these lower real interest rates will affect each of the following:

(A) The purchase of EU financial assets by American investors

(B) The international value of the euro (EU currency)

(C) EU exports of goods and services to the United States

(D) EU imports of goods and services from the United States

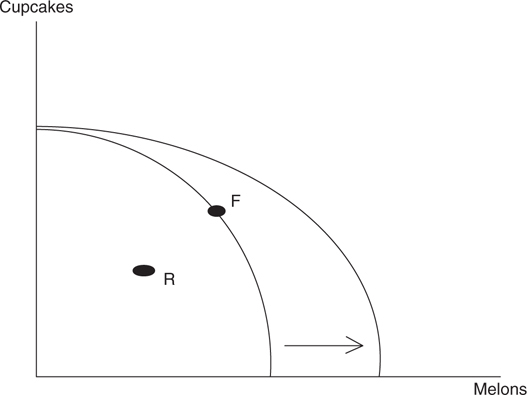

3. The nation of Melania produces only two goods: melons and cupcakes. The production possibility frontier in Melania is concave (bowed outward), and the nation is currently operating at full employment.

(A) In a correctly labeled graph, show the production possibility frontier in Melania.

i. Identify a combination of melons and cupcakes that corresponds to full employment with the point F.

ii. Does the concave production possibility frontier exhibit constant, increasing, or decreasing opportunity costs? Explain.

(B) Suppose that the economy of Melania falls into recession. Identify a combination of melons and cupcakes that corresponds to a recession with the point R. Add this point to the graph.

(C) Suppose that Melania experiences an improvement in production technology in growing melons, but this technology has no impact on the ability to produce cupcakes. In the graph from part (A), show how this better technology will affect the production possibility frontier.

![]() Free-Response Grading Rubric

Free-Response Grading Rubric

Note: Based on my experience, these point allocations roughly approximate the weighting on similar questions on the AP examinations. Be aware that every year the point allocations differ and partial credit is awarded differently.

Question 1 (10 points)

Part (A): 2 points

1 point: Given for stating that the spending policy will increase real GDP more than the tax cut policy.

1 point: Given for stating that the spending multiplier is greater than the tax multiplier. Tax cuts increase disposable income and some of that is saved, not spent, so the multiplier effect is smaller.

Part (B): 3 points

i. 1 point: Given for stating that regardless of policy, the budget will be in deficit.

ii. 1 point: Given for stating that interest rates will rise.

An additional 1 point is given for the explanation that the government borrowing causes demand for loanable funds to shift to the right (or the supply of loanable funds to shift the left).

Part (C): 1 point

1 point: Given for providing an expansionary monetary policy. Either lowering the discount rate, lowering the reserve ratio, or buying Treasury securities in an open market operation.

Part (D): 3 points

These are graphing points.

1 point: Given for a correctly drawn money market graph with the vertical axis labeled as nominal interest rate and the horizontal axis labeled as quantity of money.

1 point: Given for showing a vertical money supply curve and a downward-sloping money demand curve with the equilibrium interest rate on the vertical axis.

1 point: Given for showing an increased money supply and a decreased interest rate.

Part (E): 1 point

Identify a reason why greater money supply might not result in a large boost to real GDP.

• Money demand is very elastic.

• Investment demand is very inelastic.

• Banks hold excess reserves rather than making loans.

• Borrowers do not redeposit their loans, but hold some as cash.

Question 2 (4 points)

Part (A): 1 point: Given for stating that lower interest rates make EU financial assets less attractive to American investors, so fewer EU financial assets will be purchased.

Part (B): 1 point: Given for stating that decreased demand for the euro depreciates the euro versus the dollar and appreciates the dollar against the euro.

Part (C): 1 point: Given for stating that a depreciating euro makes EU goods look like a bargain to American consumers, increasing the demand for EU goods and services. The EU exports more goods to the United States.

Part (D): 1 point: Given for stating that an appreciating dollar makes American goods look more expensive to EU consumers, decreasing demand for U.S. goods and services. The EU imports fewer U.S. goods.

Question 3: (6 points)

Part (A): 4 points

1 point: Given for showing a concave production possibility curve (PPC) with melons and cupcakes labeled on the axes.

i. 1 point: Given for identifying point F at some point on the PPC.

ii. 1 point: Given for stating that the PPC exhibits increasing opportunity costs. 1 point for explaining that the concave shape means that increasing production of melons (or cupcakes) requires giving up more and more units of cupcakes (or melons) because the resources are not equally productive in producing melon and cupcakes. Some resources are better suited to producing melons than they are at producing cupcakes.

Part (B): 1 point

1 point: Given for showing point R somewhere inside the PPC.

Part (C): 1 point

1 point: Given for showing the PPC increasing along the melons axis but not changing on the cupcakes axis.

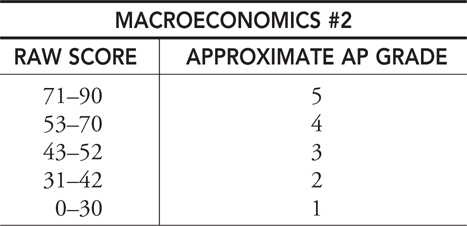

Scoring and Interpretation

AP Macroeconomics Practice Exam 2

Multiple-Choice Questions:

Number of correct answers: _____

Number of incorrect answers: _____

Number of blank answers: _____

Did you complete this part of the test in the allotted time? Yes/No

Free-Response Questions:

1. ______/10

2. ______/4

3. ______/6

Did you complete this part of the test in the allotted time? Yes/No

Calculate Your Score:

Multiple-Choice Questions:

![]()

Free-Response Questions:

Free-Response Raw Score = (1.5 × Score #1) + (1.875 × Score #2) + (1.25 × Score #3) = ______

Add the raw scores from the multiple-choice and free-response sections to obtain your total raw score for the practice exam. Use the table that follows to determine your grade, remembering these are rough estimates using questions that are not actually from AP exams, so do not read too much into this conversion from raw score to AP score.