5 Steps to a 5: AP Macroeconomics 2017 (2016)

STEP 2

Determine Your Test Readiness

CHAPTER 3 Take the Diagnostic Exam

CHAPTER 3

Take the Diagnostic Exam

IN THIS CHAPTER

Summary: This chapter includes a diagnostic exam for macroeconomics. It is only half the length of the real thing and is restricted to multiple-choice questions. It is intended to give you an idea of where you stand with your preparation. The questions have been written to approximate the coverage of material that you will see on the AP exam and are similar to the review questions that you see at the end of each chapter in this book. Once you are done with the exam, check your work against the given answers, which also indicate where you can find the corresponding material in this book. Also provided is a way to convert your score to a rough AP score.

Key Ideas

![]() Practice the kind of multiple-choice questions you will be asked on the real exam.

Practice the kind of multiple-choice questions you will be asked on the real exam.

![]() Answer questions that approximate the coverage of topics on the real exam.

Answer questions that approximate the coverage of topics on the real exam.

![]() Check your work against the given answers.

Check your work against the given answers.

![]() Determine your areas of strength and weakness.

Determine your areas of strength and weakness.

![]() Earmark the pages that you must give special attention.

Earmark the pages that you must give special attention.

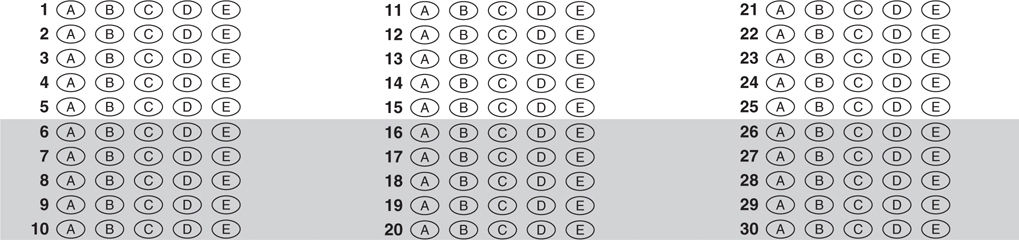

Diagnostic Exam: Answer Sheet

Record your responses to the exam in the spaces below.

MACROECONOMICS—SECTION I

Diagnostic Exam: AP Macroeconomics

SECTION I

Time—35 Minutes

30 Questions

For the following multiple-choice questions, select the best answer choice and record your choice on the answer sheet provided.

1 . Which of the following is an example of capital as an economic resource?

(A) A cement mixer

(B) A barrel of crude oil

(C) A registered nurse

(D) A share of corporate stock

(E) A bachelor’s degree

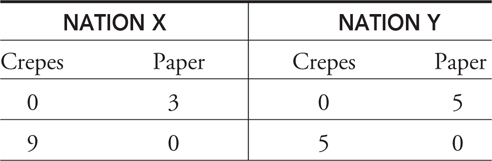

Question 2 is based on the production possibilities of two nations that can produce both crepes and paper.

2 . Which of the following statements is true of these production possibilities?

(A) Nation X has comparative advantage in paper production and should trade paper to Nation Y in exchange for crepes.

(B) Nation X has comparative advantage in crepe production and should trade crepes to Nation Y in exchange for paper.

(C) Nation X has absolute advantage in paper production, and Nation Y has absolute advantage in crepe production. No trade is possible.

(D) Nation Y has absolute advantage in paper production, and Nation X has absolute advantage in crepe production. No trade is possible.

(E) Nation Y has comparative advantage in crepe production and should trade paper to Nation X in exchange for crepes.

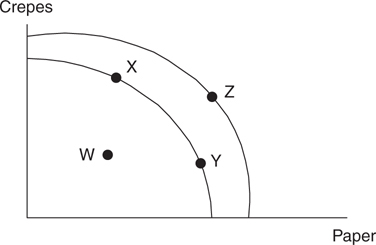

3 . Using Figure D.1 , which of the following movements would be described as economic growth?

Figure D.1

(A) W to X

(B) X to Y

(C) W to Y

(D) Z to W

(E) X to Z

4 . Suppose DVD players are a normal good and are exchanged in a competitive market. All else equal, an increase in household income will

(A) increase the equilibrium quantity and increase the price.

(B) decrease the equilibrium quantity and increase the price.

(C) increase the equilibrium price, but the change in quantity is ambiguous.

(D) decrease the equilibrium quantity and decrease the price.

(E) increase the equilibrium quantity but the change in price is ambiguous.

5 . An American firm moves a manufacturing plant from the United States to Brazil. How will this affect gross domestic product (GDP) in the United States and in Brazil?

(A) U.S. GDP falls and Brazil’s GDP falls.

(B) U.S. GDP rises and Brazil’s GDP falls.

(C) U.S. GDP falls and Brazil’s GDP remains constant.

(D) U.S. GDP falls and Brazil’s GDP rises.

(E) U.S. GDP remains constant and Brazil’s GDP rises.

6 . For years you work as a grocery checker at a supermarket, and one day you are replaced by self-serve checkout stations. What type of unemployment is this?

(A) Cyclical

(B) Structural

(C) Seasonal

(D) Frictional

(E) Discouraged

7 . If the consumer price index (CPI) increases by 2 percent and your nominal income increases by 8 percent, your real income has approximately

(A) increased by 4 percent.

(B) decreased by 4 percent.

(C) increased by 6 percent.

(D) decreased by 6 percent.

(E) increased by 10 percent.

8 . To deflate nominal gross domestic product (GDP), you must

(A) divide nominal GDP by the GDP deflator.

(B) multiply real GDP by the GDP deflator.

(C) divide real GDP by the GDP deflator.

(D) multiply nominal GDP by the GDP deflator.

(E) divide nominal GDP by real GDP.

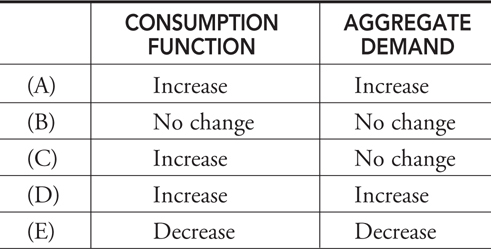

9 . A stronger stock market is likely to cause which of the following changes in the consumption function and aggregate demand?

10 . An increase in corporate optimism will have which of the following effects in the market for loanable funds?

(A) An increase in supply, lowering the interest rate.

(B) A decrease in demand, increasing the interest rate.

(C) An increase in both supply and demand, and an ambiguous change in interest rates.

(D) A decrease in supply, decreasing the interest rate.

(E) An increase in demand, increasing the interest rate.

11 . If the economy is operating below full employment, which of the following will have the greatest positive impact on real gross domestic product?

(A) The government decreases spending with no change in taxes.

(B) The government increases spending with no change in taxes.

(C) The government decreases spending and matches it with a decrease in taxes.

(D) The government holds spending constant while decreasing taxes.

(E) The government increases spending and matches it with an increase in taxes.

12 . Suppose the economy is operating beyond full employment. Which of the following is true at this point?

(A) The short-run aggregate supply curve is horizontal.

(B) Further increases in aggregate demand will result in a lower price level.

(C) A decrease in aggregate demand will result in a lower price level if prices are sticky.

(D) Further increases in aggregate demand will not lower the unemployment rate but will create inflation.

(E) The unemployment rate is higher than the natural rate of unemployment.

13 . When government uses expansionary fiscal policy, the spending multiplier is often smaller than predicted because of

(A) lower taxes.

(B) increasing net exports.

(C) falling unemployment.

(D) lower interest rates.

(E) rising price levels.

14 . The best example of a negative supply shock to the economy would be

(A) a decrease in government spending.

(B) a decrease in the real interest rate.

(C) an increase in the money supply.

(D) unexpectedly higher resource prices.

(E) technological improvements.

15 . The Phillips curve represents the relationship between

(A) inflation and the money supply.

(B) unemployment and the money supply.

(C) the money supply and the real interest rate.

(D) inflation and unemployment.

(E) investment and the real interest rate.

16 . If the economy is experiencing a recession, how will a plan to decrease taxes for consumers and increase spending on government purchases affect real gross domestic product (GDP) and the price level?

(A) real GDP rises and the price level falls.

(B) real GDP falls and the price level rises.

(C) real GDP rises and the price level rises.

(D) real GDP falls and the price level falls.

(E) real GDP stays the same and the price level rises.

17 . Of the following choices, the one most likely to be preferred by supply-side economists would be

(A) increased government spending.

(B) higher tariffs on imported goods.

(C) lower taxes on household income.

(D) higher welfare payments.

(E) a tax credit on capital investment.

18 . Automatic stabilizers in the economy serve an important role in

(A) increasing the length of the business cycle.

(B) balancing the budget.

(C) increasing a budget surplus in a recession.

(D) decreasing net tax revenue during economic growth.

(E) lessening the impact of a recession.

19 . The “crowding-out” effect is the result of

(A) decreasing interest rates from contractionary fiscal policy.

(B) increasing interest rates from expansionary fiscal policy.

(C) increasing interest rates from expansionary monetary policy.

(D) increasing unemployment rates from expansionary monetary policy.

(E) a depreciating dollar versus other currencies.

20 . In a recession, expansionary monetary policy is designed to

(A) decrease aggregate demand so that real prices will decrease, which is good for the economy.

(B) increase aggregate demand, which will increase real output and increase employment.

(C) increase unemployment, but low prices negate this effect.

(D) keep interest rates high, which attracts foreign investment.

(E) boost the value of the dollar in foreign currency markets.

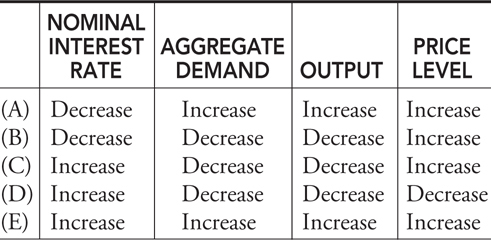

21 . A contractionary monetary policy will cause the nominal interest rate, aggregate demand, output, and the price level to change in which of the following ways?

22 . Which of the following is a tool used by the Fed to increase the money supply?

(A) A lower discount rate.

(B) Selling Treasury securities to commercial banks.

(C) A higher reserve ratio.

(D) A lower personal income tax rate.

(E) A lower investment income tax rate.

23 . Which of the following monetary policies would lessen the effectiveness of expansionary fiscal policy?

(A) Decreasing the value of the domestic currency.

(B) Lowering the income tax rate.

(C) Selling Treasury securities to commercial banks.

(D) Lowering the discount rate.

(E) Lowering the reserve ratio.

24 . Which of the following is an accurate statement of the money supply in the United States?

(A) The money supply is backed by gold reserves.

(B) The least liquid measure of money is M 2.

(C) M 1 is larger than M 3.

(D) Paper money can be exchanged at commercial banks for an equal amount of gold.

(E) The most liquid measure of money is M 1.

25 . Excess reserves in the banking system will increase if

(A) the reserve ratio is increased.

(B) the checking deposits increase.

(C) the discount rate is increased.

(D) the Fed sells Treasury securities to commercial banks.

(E) income tax rates increase.

26 . If a bank has $1,000 in checking deposits and the bank is required to reserve $250, what is the reserve ratio? How much does the bank have in excess reserves? What is the size of the money multiplier?

(A) 25%, $750, M = ¼

(B) 75%, $250, M = 4

(C) 25%, $750, M = 4

(D) 75%, $750, M = ¼

(E) 25%, $250, M = 4

27 . Suppose the reserve ratio is 10 percent and the Fed buys $1 million in Treasury securities from commercial banks. If money demand is perfectly elastic, which of the following is likely to occur?

(A) Money supply increases by $10 million, lowering the interest rate and increasing AD.

(B) Money supply remains constant, the interest rate does not fall, and AD does not increase.

(C) Money supply increases by $10 million, the interest rate does not fall, and AD does not increase.

(D) Money supply decreases by $10 million, raising the interest rate and decreasing AD.

(E) Money supply decreases by $10 million, the interest rate does not rise, and AD does not decrease.

28 . If the world price of copper exceeds the domestic (U.S.) price of copper, we would expect

(A) the United States to be a net exporter of copper.

(B) the United States to impose a tariff on imported copper to protect domestic producers.

(C) the demand for U.S. copper to fall.

(D) a growing trade deficit in the United States in goods and services.

(E) the dollar to depreciate relative to the currencies of other copper-producing nations.

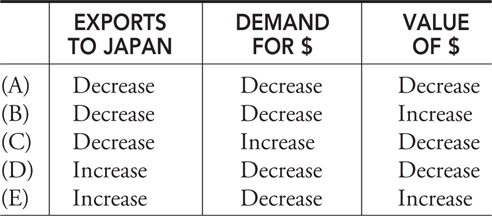

29 . Suppose the Japanese economy is suffering a prolonged recession. Lower Japanese household incomes will affect U.S. exports to Japan, demand for the dollar, and the value of the dollar relative to the yen in which of the following ways?

30 . Which of the following is a likely effect of a higher tariff imposed by the United States on imported automobiles?

(A) Net exports will fall and the dollar will appreciate in value.

(B) Net exports will fall and the dollar will depreciate in value.

(C) The price of automobiles in the United States will fall.

(D) Net exports will rise and the dollar will depreciate in value.

(E) Net exports will rise and the dollar will appreciate in value.

Macroeconomics Answers and Explanations, Section I

This test was designed to test you on topics that you will see on the AP Macroeconomics exam in the approximate proportions that you will see them. Chronologically they appear in the approximate order of their review in Step 4 of this book, but this is not the case on the AP exam. Topics on your practice exams will be shuffled.

Questions from Chapter 5

1 . A —Economic capital includes machinery, like a cement mixer, used to produce goods and services. A barrel of oil is a natural resource, and a nurse is a unit of labor. A share of corporate stock is a financial instrument used to raise money so that a firm can purchase more economic resources.

2 . B —A quick calculation of opportunity costs shows that the opportunity cost of one more paper is three crepes in Nation X and one crepe in Nation Y. The opportunity cost of one more crepe is one-third paper in Nation X and one crepe in Nation Y. Nations benefit by specializing in the goods for which they have a comparative advantage. Thus, Nation Y can specialize in paper production, and Nation X can specialize in crepe production. Nation X trades some crepes to Nation Y in exchange for paper.

3 . E —Economic growth occurs when the production possibility frontier shifts outward. A movement from W to X or to Y is an improved allocation of unemployed resources, but the potential production has not grown for this nation.

Questions from Chapter 6

4 . A —If DVDs are normal goods, an increase in household income increases demand for DVDs, which increases quantity and price. Even though this is a macroeconomics exam, be prepared for simple supply and demand questions to test your understanding of markets.

Questions from Chapter 7

5 . D —The GDP of a nation includes the value of production done within the borders of that nation, regardless of the nationality of the owners. If a U.S. factory moves to Brazil, U.S. GDP falls and it rises in Brazil.

6 . B —Structural unemployment is the result of changing demand for skills, not the business cycle. Automation decreases the demand for human grocery checkers, and this trend is unlikely to reverse itself.

7 . C —The percentage change in real income is approximately equal to the percentage change in nominal income minus the percentage change in the price level.

8 . A —Nominal values must be adjusted to take into account rising prices. To deflate nominal values to real values, divide the nominal value by the price index (in hundredths).

Questions from Chapter 8

9 . D —A strong stock market increases consumer wealth and optimism, shifting the consumption function upward. Since aggregate demand includes consumption, aggregate demand increases.

10 . E —In the market for loanable funds, investment (I ) represents demand and saving represents supply. More $I increases the demand for loanable funds and increases the interest rate.

11 . B —The spending multiplier is larger than the tax multiplier, which is larger than the balanced budget multiplier (equals 1). If you want the largest increase in real GDP, you should increase government spending and leave taxes unchanged. The largest impact would be seen if we increased spending and decreased taxes, but this is not one of your options.

Questions from Chapter 9

12 . D —If the economy is beyond full employment, the short-run AS curve is nearly vertical. At this point, increasing aggregate demand cannot increase output and will only increase prices.

13 . E —The full multiplier is only felt if short-run aggregate supply is horizontal. Any increase in the price level decreases the impact of the spending multiplier.

14 . D —Higher resource prices shift the short-run aggregate supply (SRAS) curve to the left. All other choices either do not impact the SRAS curve or they would act as positive shocks to the SRAS curve.

15 . D —The Phillips curve shows the short-run inverse relationship between the inflation rate and the unemployment rate. In the long run, this curve is vertical at the natural rate of unemployment.

Questions from Chapter 10

16 . C —In the aggregate demand (AD) and aggregate supply (AS) model, lower taxes and more government spending increases AD. This rightward shift increases real GDP and begins to increase the price level.

17 . E —Supply-side economists advocate increased aggregate supply through incentives for investment and productivity. These would likely come in the form of lower taxes on interest income from savings or tax credits for investment.

18 . E —As a recession deepens, a progressive tax system and transfer programs like welfare assistance kick in and shorten the downturn in the business cycle. These automatic stabilizers produce recessionary deficits and inflationary surpluses.

19 . B —Expansionary fiscal policy, intended to boost aggregate demand, that requires borrowing increases interest rates and lessens private investment spending. The decrease in investment spending weakens the impact of expansionary fiscal policy.

Questions from Chapter 11

20 . B —Increasing the money supply lowers interest rates and increases investment spending (I ), aggregate demand (AD), real GDP, and employment.

21 . D —A contractionary money supply increases nominal interest rates, decreases aggregate demand and real GDP, and decreases the price level.

22 . A —A lower discount rate increases excess reserves by making it less costly for commercial banks to borrow from the Fed. This is one of the Fed’s tools of monetary policy. Remember that the Fed does not impact taxes, as taxes are fiscal policy made by the executive and legislative branches.

23 . C —Selling securities would draw down excess reserves in the banks, decrease the money supply, and increase the interest rate. This would work counter to expansionary fiscal policy.

24 . E —Nearest to cash, M 1 is the most liquid of monetary measures. The U.S. dollar is not backed by gold. Our fiat money has value because the Fed ensures stable prices.

25 . B —When more deposits are made, the bank increases required reserves by the fraction of the reserve ratio, and increased excess reserves are lent to borrowers to create more money.

26 . C —The reserve ratio is required reserves divided by deposits, so rr = 0.25. With $250 in required reserves, excess reserves are $750. The money multiplier is equal to 1/rr = 4.

27 . C —The money multiplier is 10 because the reserve ratio is 0.10. If money demand is horizontal, a $1 million increase in excess reserves shifts the money supply curve rightward by $10 million but will not lower the nominal interest rate. If the interest rate does not fall, aggregate demand does not rise.

Questions from Chapter 12

28 . A —Nations are net exporters of a good when the world price is greater than the domestic price. A higher world price creates a surplus in the domestic market and the surplus is exported. This situation improves the U.S. balance of trade and would not foster any U.S. protective trade policy. In currency markets, the dollar likely appreciates, as foreign consumers need dollars to buy U.S. copper.

29 . A —When relative incomes are falling in Japan, fewer U.S. goods are demanded, so U.S. exports fall. The decrease in the demand for U.S. dollars causes the dollar to depreciate.

30 . E —A tariff causes imports to fall, so net exports rise for the U.S. With fewer consumers demanding foreign-built cars, the demand for foreign currency falls, decreasing the value of foreign currency, appreciating the value of the U.S. dollar.

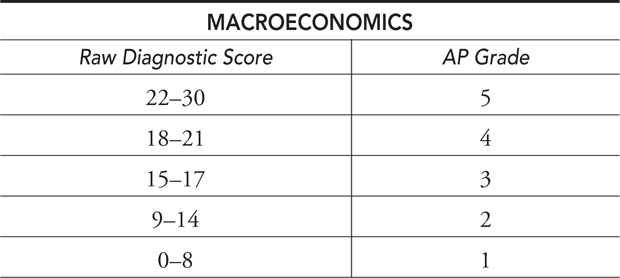

Scoring and Interpretation

Now that you have completed the diagnostic exam and checked your answers, it is time to assess your knowledge and preparation. If you saw some questions that caused you to roll your eyes and mutter “What the … ?” then you can focus your study on those areas. If you breezed through some questions, great!

Calculate your raw score with the formula that follows. If you left any questions blank, there is no penalty. Take this raw score on the diagnostic exam and compare it to the table that follows to estimate where you might score at this point.

Section I Raw Score = Nright

Remember, on the real exam, Section I will account for two-thirds of your composite score, with one-third coming from the free-response Section II. Given this important difference between your diagnostic exam and the real thing, the table above is a very preliminary way to convert your diagnostic raw score to an AP grade. No matter how you scored on the diagnostic exam, it is time to begin to review for your AP Macroeconomics Exam.